Total gross annual income calculator

To convert to yearly income depending on the way you get paid. Gross Annual Income of hours worked per week x of weeks worked per year x hourly wage Example Lets calculate an example together.

How To Calculate Gross Pay Youtube

Total annual gross income is the total amount of money you receive in a given year.

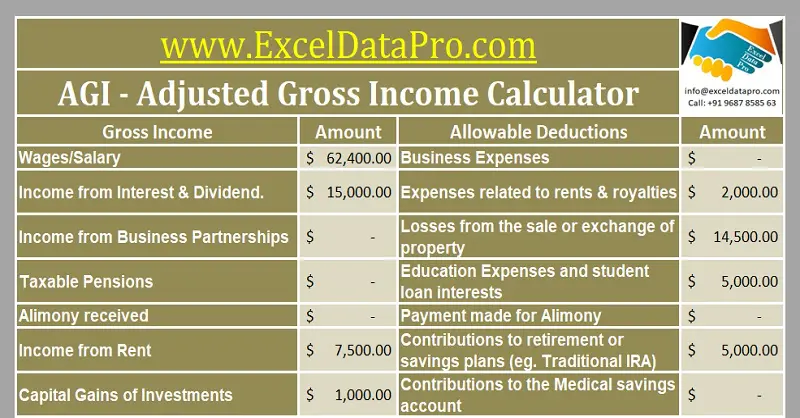

. AGI gross income adjustments to income Gross income the sum of all the money you earn in a year. Your gross income is a measure that includes all money property. Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors.

Multiply this by 52 to arrive at your gross yearly income of 20800 52 x 400. When referring to your personal income you would use calendar year dates to determine. 12 x the monthly rate 50 x the weekly rate 250 x the daily rate 2000 x the hourly rate You see working.

Calculate the Gross Total Income You must calculate the gross total income under the different heads of income. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year. Sara works an average of.

Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes. This deduction also cannot be claimed if.

Multiply your hourly wage by the number of hours youve worked. These rates are applicable for the assessment year 2022-23 during which taxes for the year 2021-22 are. Annual Income 15hour x 40 hoursweek x 52 weeksyear Annual Income 31200 Your annual income would be 31200.

The adjusted annual salary can be calculated as. Regular Military Compensation RMC is defined as the sum of basic pay average basic allowance for housing basic allowance for subsistence. How to Calculate Your Total Gross Annual Income When it comes to total gross annual income youd take your hourly rate and multiply it by the hours you work per week and.

Multiply the amount of hours you work each week by your hourly salary. Include any extra compensation on top of your gross pay. A simple formula can also be used to calculate your annual income.

Estimated number of hours worked per week x hourly rate x 52 gross annual income The 52 represents the number of weeks you work throughout the year. Call 1-800-550-2684 Find a Chase Home Lending Advisor or Consider. If you receive 5000 per year in child.

Ad Use The Tax Calculator to Estimate Your Tax Refund or the Amount You May Owe The IRS. Regular Military Compensation RMC Calculator. Using the annual income formula the calculation would be.

30 8 260 - 25 56400 Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of. Income From Salary- Add the total gross salary received from the. Multiply that amount by 52 the number of weeks in a year the number of weeks in a year.

If you work full-time 8 hours a day 5 days.

Hourly To Salary What Is My Annual Income

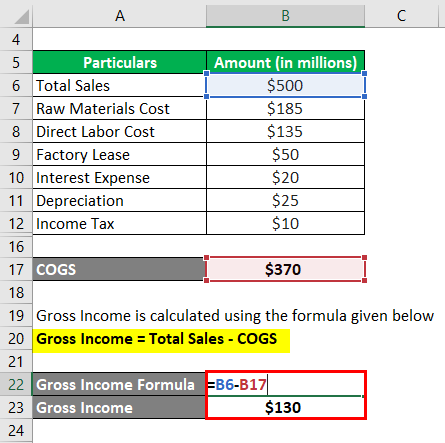

Gross Income Formula Calculator Examples With Excel Template

Gross Pay And Net Pay What S The Difference Paycheckcity

4 Ways To Calculate Annual Salary Wikihow

Salary Calculator

How To Calculate Gross Income Per Month

How To Calculate Gross Weekly Yearly And Monthly Salary Earnings Or Pay From Hourly Pay Rate Youtube

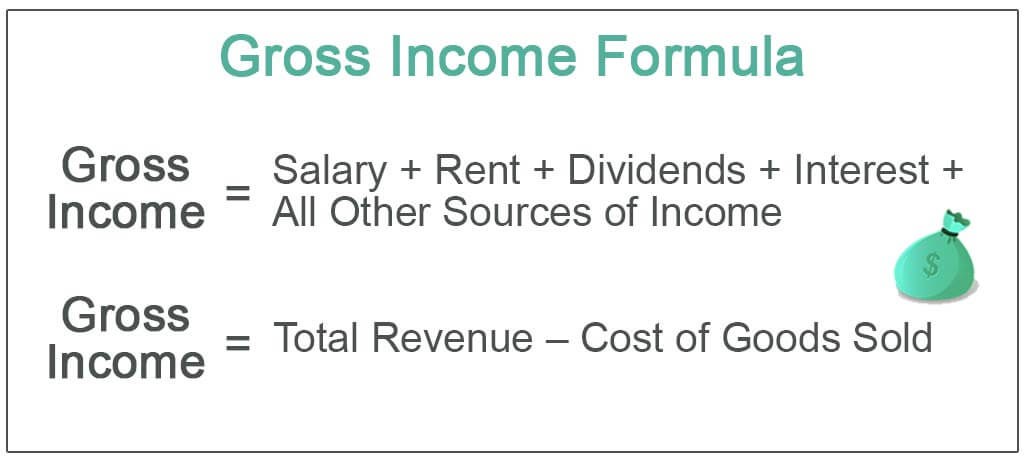

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Income Formula Calculator Examples With Excel Template

Annual Income Calculator

Gross Income Formula Step By Step Calculations

Annual Income Definition Calculation And Quiz Business Terms

Monthly Gross Income Calculator Freeandclear